Zeropark Teams are in full-throttle preparations for Black Friday – Cyber Monday week and the shopping frenzy before the holidays. Probably so are you if you work in the industry.

Every year, we try to predict the best trajectory for maximizing advertising performance during these crazy weeks, and 2023 is no different.

We have long prioritized understanding of consumers in all marketing and advertising planning.

How will consumers spend during the 2023 holidays?

It’s no secret that Q4 is the busiest of periods for Zeropark advertisers, as the consumers are at their peak form when it comes to shopping. Black Friday – Cyber Monday, Thanksgiving, Christmas, and more: all these occasions usually become opportunities to buy at special prices or to splurge a bit to spoil relatives.

Holiday retail sales in the United States from 2002 to 2022 (in billion U.S. dollars)

The state of the economy has been volatile in the last couple of years, with many disruptors appearing along the way. These changed how we shop but also influenced our sense of financial stability. And while the intuitive reaction would be to save funds, especially with prices rising globally, the shoppers do quite the opposite – they shop more.

2023 will bring higher spend

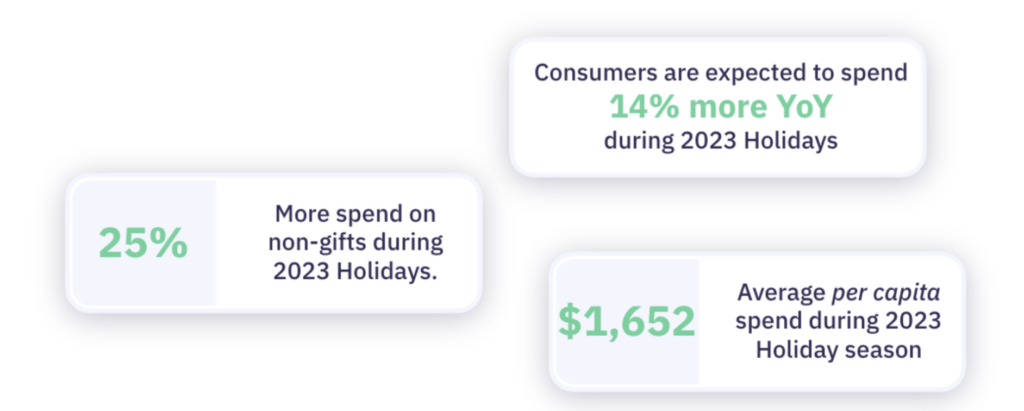

In 2023, shoppers will surpass the pre-COVID per capita level of Holiday Retail spend, with an impressive 14% increase YoY. As was found out in the 2023 Deloitte Holiday Retail Survey, an average shopper will spend $1,652 on holiday-related purchases ($1,496 in December 2019).

Gifts purchases

However, we shouldn’t attribute the increase only to shopping for gifts. Experts anticipate that an average customer will shift more of their budgets (up to 25% YoY) to buying clothes, home accessories, and gadgets without the intention of gifting them. It means that modern consumers simply use holiday discounts to buy all needed products or restock them.

2023 Deloitte Holiday Retail Survey

On top of that, consumers expect to pay 9% more for gifts. With the increasing budgets, consumers will actually buy fewer presents compared to 2022. It is a part of an ongoing trend that drives consumer focus from quantity to quality.

What does it mean for advertisers?

This is big news for advertisers, as it appears that the AOVs will significantly improve during the high shopping season. On top of that, holiday-propelled audience volumes and conversion rates should bring even more traction to the brands. If we combine all these, the big potential for all commerce media retailers is noticeable. It’s the perfect opportunity to maximize revenues in the final sprint before the end of the year. All due to peak consumer purchase intent.

But to drive these sales and conversions to one’s advertising, it is essential to correctly respond to consumer needs. Advertising in Q4 can get particularly overwhelming, with banner ads, disruptive content, and an overall abundance of messages. To aid your customers with relevant offers, optimize commerce media advertising to best nurture your ICPs.

To find out more about how modern consumers in commerce media shop, their expectations from brands, and how you can scale your advertising ventures during the holiday season, get your copy of Zeropark’s latest BFCM & Q4 Holiday Shopping Report 👇

Łukasz Pośpiech