In this world, nothing can be said to be certain, except death and taxes… and profits from tax-season affiliate campaigns as Benjamin Franklin would surely say, had he been a super affiliate. Only you don’t need to be a super affiliate to make money at this time of the year. With the 2022 US tax season in full swing, there’s no better time to hit it big.

Here’s how to maximize your profits running 2022 tax season ad campaigns. Read on and scale up!

What’s the US Tax Season? What’s the IRS?

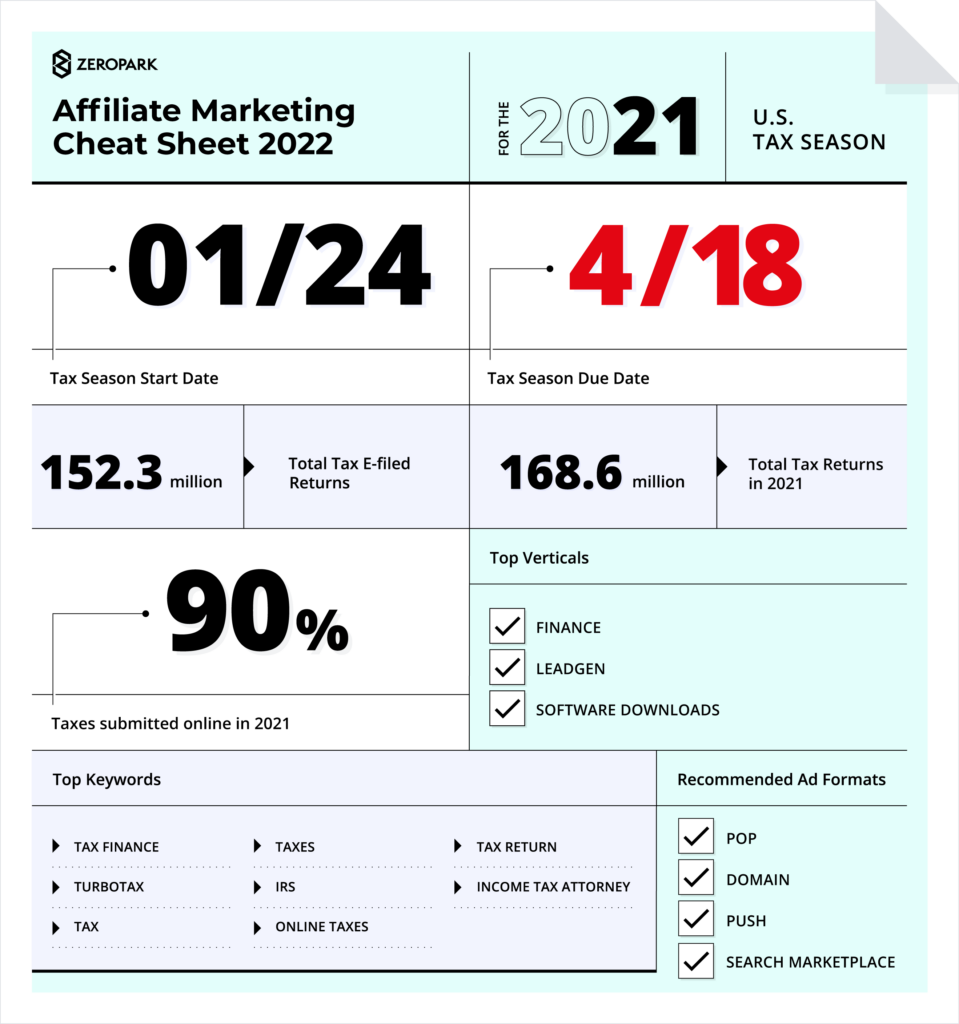

The 2022 US Tax season begins on January 24 and goes till April 18. During this time, the IRS (Internal Revenue Service) accepts tax returns from US citizens. Although normally tax-payers have almost twelve weeks to submit their statements (limited to only 9 weeks this year), the tax season’s peak occurs right before the deadline. As for chronic procrastinators, those who want to file for an extension with the IRS must do so before the deadline, that is April 18th, or face the consequences. Sounds serious enough? Luckily for any affiliate advertisers out there — it does.

Filing tax forms and dealing with tax calculations wreaks havoc amongst millions of people, every year, with zero chances for escaping it. Even an honest mistake can get you in real trouble with the government and nobody wants to mess with the IRS. So, unless you’re really into finances and calculations, filing tax returns requires assistance.

[blog-banner id=”4716″ name=”zp-bfcm-in-text-banner-with-deals”]

How can affiliates make money on the US Tax Season 2022?

To aid all those in need, there are services that guide tax-payers through the process and help them get past the tax season as stress-free as possible. With the whole of the US turning to such companies all at once, just imagine the demand. Yes, it’s hitting through the roof. Firms like H&R Block, TurboTax, Credit Karma Tax, and many others are having momentum. And the best part is — so can you.

This is because most of the US tax-filing services offer affiliate programs. Promoting their offers, especially at this time of the year, comes with an almost sure-fire surge of traffic and target audience interest. Here’s how to get your share of the tax season profits.

Affiliate Offers for the US Tax Season ad campaigns

From the affiliate marketer’s point of view, running tax-season-related offers falls under the finance vertical. Bur finance is not the only vertical worth exploring right now as lead generation campaigns and software downloads tend to spike during the tax season, too. This is because all three verticals relate to 2022 tax-filing trends — people choose to calculate what’s due either via software or online.

As mentioned before, advertisers can get their tax-season offers straight from the tax-firm programs. See examples below:

Another option would be to search through affiliate networks. Since such networks aggregate various offers from a wide range of verticals, there’s a chance of getting tax-season-related offers, too. See examples below, and if interested head to the page for details.

- H&R Block offers by FlexOffers

- H&R Block offers by Skimlinks

- H&R Block offers by FMTC

- H&R Block offers by Yazing

- H&R Block offers by Viglink

- Credit Karma Tax by Yazing

- Credit Karma Tax by FMTC

- TaxAct by FlexOffers

- The various tax affiliate program offers by FlexOffers

Targeting the US Tax Season ad campaigns

A week prior to the beginning of the season, TurboTax had already pushed its advertising efforts quite up the ladder, placing itself as the number 4 leading TV advertiser in the US.

But that’s not all. According to Statista, TurboTax spent more than $90 million on TV advertising alone, with H&R Block coming next with more than $80 million spent.

With tax-filing services spending vast amounts of money for all kinds of advertising — from TV commercials to digital advertising — the US citizens are under the radar. So if you’re wondering how to target US tax-season ad campaigns so that your ads convert, then people, timing, and place are everything.

US Tax Season Target Audience

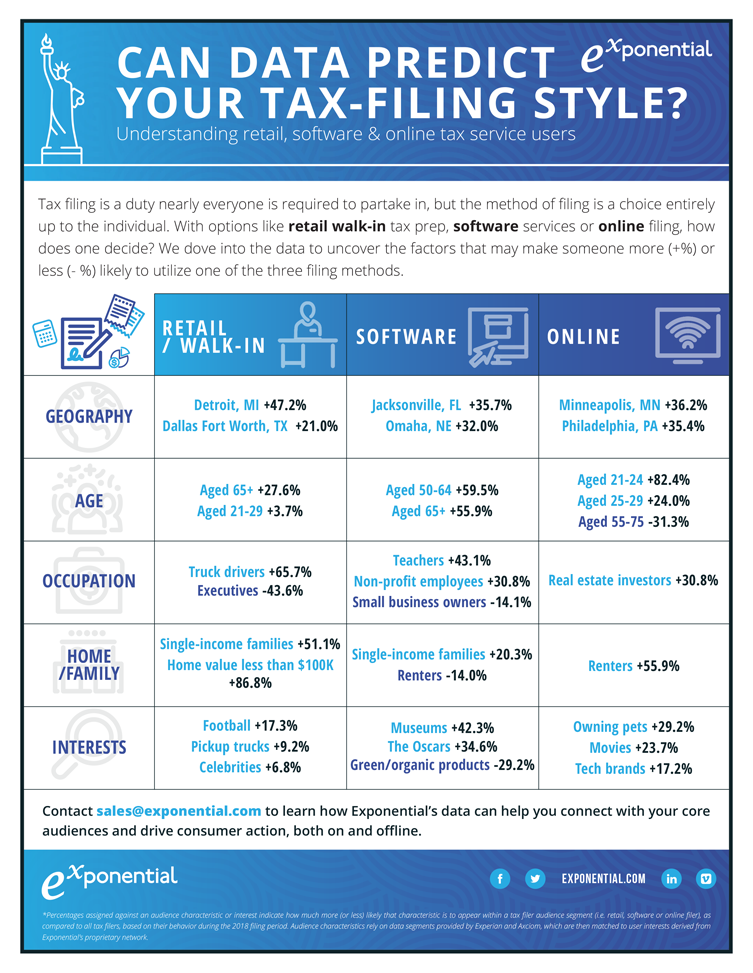

With tax-filing services battling one another in a short yet intense fight for customers, an overview of collected data may be helpful in identifying the right target audience for your affiliate ad campaigns.

Although demographics and interests can’t be targeted by traffic sources automatically, advertisers can still use this knowledge to adjust their campaigns. This refers to:

- Ad copy and creatives

- Device types, browsers, IOs, etc.

- Day-parting

- Frequency filtering

Calculations, estimations, and predictions are what this business is often based on. That’s why careful filter selection to match your audience’s profile and likings may be the key to the success of your campaign.

Especially with detailed year-by-year data waiting just a few clicks away.

US Tax Season Advertising Timing

Why a short yet intense battle, though? Well, for one thing, the tax season doesn’t last that long. Let us remind you this year’s tax season started on Monday, 24 January, and will last till Wednesday, 18 April 2022. Less than a dozen weeks during which US citizens need to file their tax statements — not much time if you think of millions of people this actually involves.

According to Forbes, although there’s not much time, people in the US don’t seem to be in a rush… yet. Numbers clearly show that the closer the deadline is, the bigger the interest and number of statements flowing in.

This means there’s still enough time for affiliate advertisers to:

- Find tax-related offers.

- Prepare ad copy and creatives.

- Plan the targeting strategy.

- Test and optimize tax season ad campaigns.

- Scale up to make a profit running tax season ad campaigns.

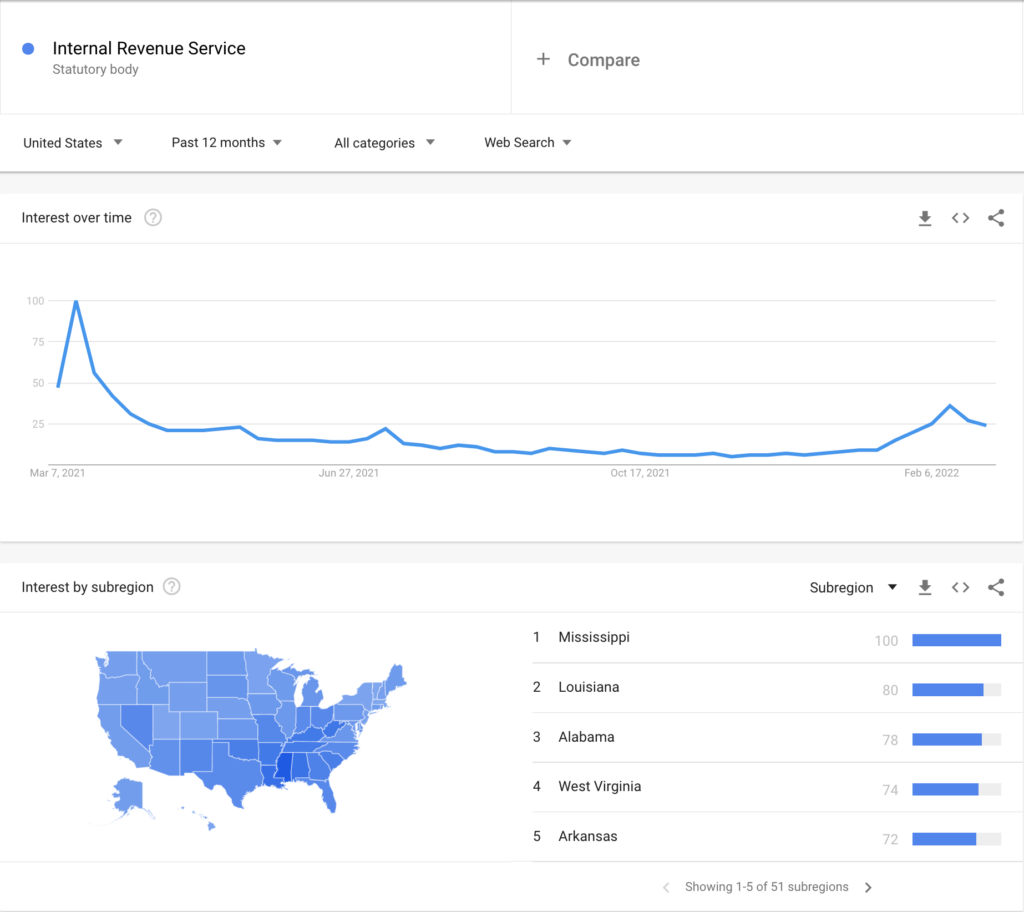

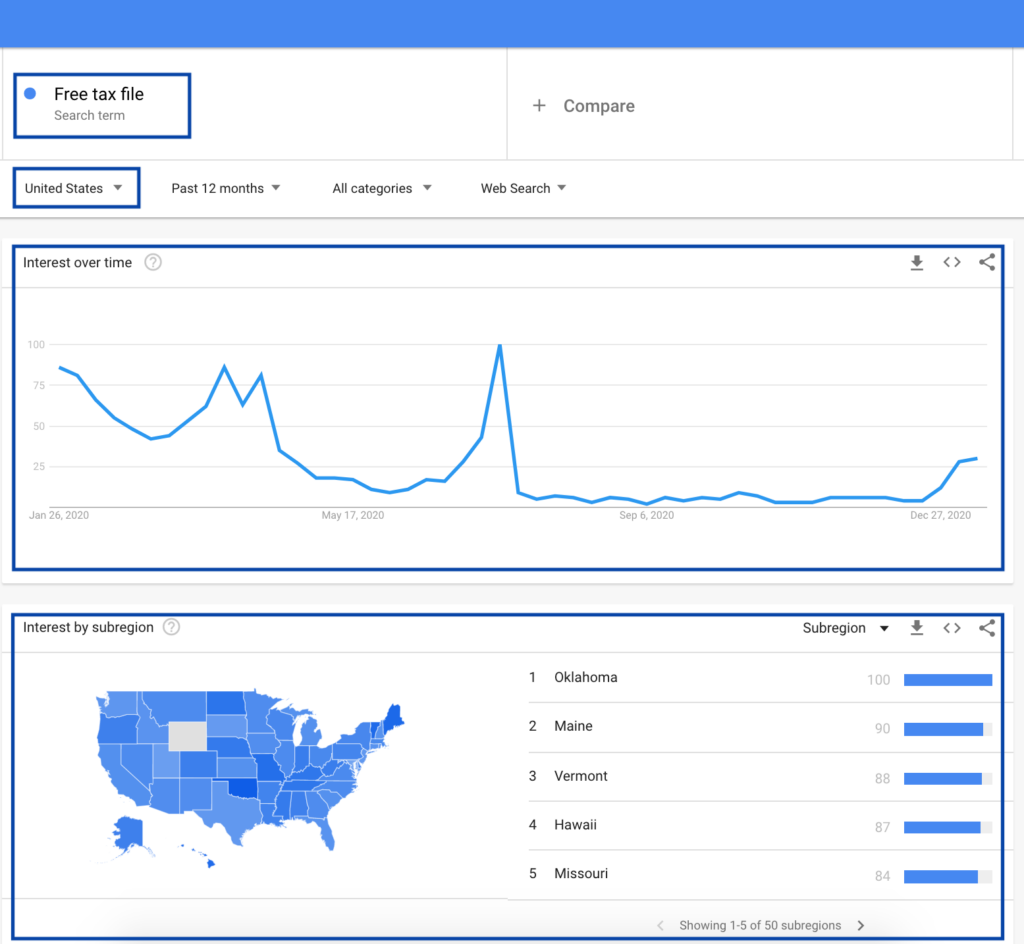

See how the Google search trends spike around the tax season key dates, do your research, and launch US tax season ad campaigns.

US Tax Season Location Targeting

The nature of such campaigns does limit the location-based targeting to the US alone. The same case scenario (only properly adjusted) can be used for Canada, the UK, Australia… or any other country in the world. Regardless of the geographical location, the taxation system can really make one’s head spin and thus requires a substantial dose of assistance. Given the current circumstances and the digitalization of almost anything (thanks, covid-19), that often means online tax assistance.

Yet, getting more granular and running campaigns targeted at specific regions may also be a way to go when speaking of the US alone. Data delivered by the IRS itself can help figure out where the tax season’s peak has already happened and where it’s still to come — in such a case focusing on these areas means higher chances for profit.

Read the guide to

Zeropark Search Marketplace ads here!

US Tax Season advertising ideas

That dreaded day when Uncle Sam comes to collect the tax money, or rather when people need to deliver it themselves, is coming soon. Since adjusting your ads to match the occasion is an evergreen piece of advice, here are some ideas for the US tax season ad campaigns.

1. Numbers don’t lie!

The tax season deadline is on Thursday, 18 April. The tax form number is 1040. Use and combine numbers 4, 18, 1040 into your ads as the US audience will instantly connect these with the tax season. They can be used in your ad copy, headlines, images, example promo codes, percentage of discounts, etc.

2. Keep the ad copy both short and relevant!

Use the exact USP of a tax service (Unique Selling Proposition), e.g.:

- $0 filing/ $0 cost

- Simple federal filing for free

- Get your biggest possible refund fast

- File your tax return for free!

- Click here for $0 cost tax-returns

- Give Uncle Sam what’s his — but not a $ more!

If using pre-landers:

- Make them look like a tax-service homepage.

- Allow users to find more details about tax-services offers like pricing, plans, deadlines.

- Help people navigate and understand what they’re actually looking at.

- Use phrases that immediately capture the customer’s attention.

- And convey exactly how the service can help them.

3. Let users see that CTA button!

Contrasting and eye-catching CTAs highlight the primary USP of the product and encourage users to take action, for example:

- Save Up Here

- Get Started

- File free

- Find out more

4. Credibility, baby!

Assure users your offer is not a scam and by purchasing the tax services they also buy a guarantee of accuracy — remember that’s the primary reason why they’re not filing the statements by themselves!

Ad formats for the US Tax Season ad campaigns

Using pop and domain redirect traffic for your tax-season campaigns is always a good idea. Both ad formats are cheap, nearly effortless to run, and enable keyword targeting — especially useful if targeting precise products/services.

Find out more about the best

domain redirect traffic tips and tricks.

Learn how to run keyword campaigns that convert

Learn how to run keyword campaigns that convert

Zeropark Traffic Insights for the US Tax Season ad campaigns

Since we mentioned that keyword targeting may do the trick with tax season ad campaigns, here’s a not-so-short example whitelist with relevant keywords and suggested bids for a domain redirect traffic source for the US market.

Mind that the below keywords are a collection of:

- one week data only

- for one particular source

- just for domain traffic

- exclusively for the US market

This means that there are plenty of other sources and targets for the US market for domain redirect traffic, as well as for pop traffic. The below list should help you identify the tax-season-related keywords and help you choose the best setup for your campaigns — whether you’re promoting TurboTax, H&R Block, TaxAct, or any other tax company.

NOTE: Remember that when using the H&R Block keyword, it should be inserted without an ampersand. Instead of submitting H&R Block, use hrblock or hr block.

You can always check the GEOs, sources, or keywords performance as well as suggested average bids by heading to the Traffic Calculator tool. Mind the bids presented below or in the system tool are average estimations. This means they should still be adjusted and optimized for the most optimal setup and successful performance of your campaigns.

↓ Example Keywords Here ↓

| turbotax | $1.358 |

| irs tax,tax return,tax form | $0.476 |

| tax form,tax return,tax filing | $0.333 |

| tax service,tax return | $0.237 |

| tax refund | $0.300 |

| hrblock,software,tax software | $1.220 |

| tax | $0.199 |

| taxpayer | $1.128 |

| labcorp,tax lawyers | $0.187 |

| tax collector | $0.274 |

| efile taxes | $0.412 |

| turbotax,tax preparation,tax services,tax return | $1.431 |

| tax refund,tax filing | $0.245 |

| tax filing,tax service | $0.130 |

| tax form,tax preparation | $0.287 |

| hrblock,tax refund,tax filing | $2.074 |

| tax return | $0.196 |

| e filing,tax return | $1.009 |

| turbotax,tax return,tax filing,tax services | $0.436 |

| file state taxes | $0.140 |

| tax refund,irs refund | $0.161 |

| tax payment | $0.288 |

| taxact,tax refund,tax filing | $0.594 |

| tax preparation,tax return | $0.223 |

| mytaxcollector | $0.057 |

| tax form,tax return,tax refund | $0.153 |

| hrblock,tax preparation,tax services,tax return | $3.797 |

| tax preparation | $0.152 |

| direct tax free | $0.077 |

| tax return,tax service | $0.329 |

| irs tax return | $0.294 |

| hrblock,tax return,tax filing,tax services | $0.788 |

| tax revenue data | $0.098 |

| irs,tax refund | $0.165 |

| real estate,tax | $0.162 |

| dallas county tax | $0.466 |

| liberty tax | $0.985 |

| tax return,tax services | $0.270 |

| jackson hewitt,tax preparation,tax return | $0.378 |

| liberty tax,tax refund,tax filing | $0.930 |

| taxslayer,tax preparation | $1.202 |

| carrefourtax refund,irs refund | $0.221 |

| tax division | $0.159 |

| tax payment system | $0.373 |

| tax assessor | $0.332 |

| tax software | $0.279 |

| taxact,tax return,tax filing,tax services | $0.615 |

| irs,tax filing | $0.278 |

| turbotaxtax service,tax return | $1.172 |

| etax | $0.243 |

| eztaxreturn | $0.603 |

| income tax online returns | $0.058 |

| sumpter tax collector | $0.489 |

| tax refund,tax filing,tax filing software | $0.190 |

| turbotax,tax refund,tax preparation software | $1.189 |

| tax department | $0.163 |

| tax package support | $0.171 |

| tax service | $0.160 |

| turbo tax business software | $0.059 |

| turbotax,tax return,tax filing | $0.575 |

| irs,tax return,tax filing | $0.557 |

| property tax | $0.200 |

| tax filing | $1.150 |

| nbr tax calculator bc | $0.305 |

| comal county tax office | $0.197 |

| tax return,tax refund | $0.216 |

| tax free | $0.133 |

| county record,real estate records,tax record | $0.188 |

| hp,tax planning | $0.036 |

| tax audit | $0.263 |

| tax free uk | $0.417 |

| tax services | $0.247 |

| tax statements | $0.313 |

| glacier tax | $0.168 |

| instant tax | $0.079 |

| maryland taxes | $0.143 |

| tax forms | $0.252 |

| www free taxes | $1.662 |

| maryland land taxes | $0.202 |

| miami dade-county-taxes | $0.163 |

| tax freedom act | $0.042 |

| taxact | $0.630 |

| taxact returning user | $0.023 |

| taxes | $0.052 |

| turbotax,tax return,tax services | $1.289 |

| nj taxation | $0.013 |

| tax colorado | $0.004 |

| additional tax | $0.021 |

| american funds tax forms | $0.004 |

| ez tax,tax refund | $0.258 |

| national tax experts | $0.141 |

| tax preparation,tax calulation,tax service | $0.004 |

↓ Watch the Keyword Campaign Tutorial for

step-by-step instructions on

how to set your campaigns in Zeropark ↓

Maximize Your Profits Running Tax Season Ad Campaigns Before The Deadline on 4/18!

Head to Zeropark Now!

Kinga Gawron